UNIFIED TARIFF GUIDELINES – AN ANALYSIS

WHAT IT ENCOMPASSES (IN SIMPLIFIED TERMS) & IMPLICATIONS FOR THE INDIAN GAS SECTOR

By Anshuman Khanna[1]

- BACKGROUND

- The Petroleum & Natural Gas Regulatory Board (PNGRB) is the regulator for various matters including the regulation of cross-country gas pipelines in India.

- Cross-country gas pipelines serve the purpose of transporting domestic gas from source fields to consumers as well as imported regasified LNG (R-LNG) from LNG terminals to the consumers.

- Gas pipelines have been put up by different companies such as GAIL, IOC, GSPL and others over time under approval from PNGRB and the tariff they charge from shippers of gas is fixed by PNGRB based on the Capex and Opex incurred by such companies on the pipelines duly vetted by PNGRB, so as to provide a reasonable return to such companies. This tariff is referred to as ‘Approved Tariff’ and is paid by the user/shipper to the Gas pipeline owner.

- The Gas Pipeline owner charges the Approved Tariff from shippers on actual quantity (per MMBTU) shipped or in case of minimum ‘ship or pay’ commitments, where actual quantity shipped is less than the minimum commitment, then on the minimum committed volume.

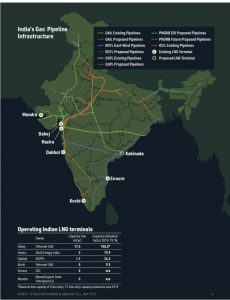

- Figure below provides the Gas infrastructure in India in terms of Gas pipelines and LNG terminals.

- It has long been debated to move towards a ‘National Gas Grid’ concept wherein all the pipelines form part of a common grid accessible to all users/shippers no matter where they originate the gas and where they wish to have the gas delivered to them. This is envisaged with a unified tariff payable for shipping of gas. This is in consonance with the Government of India’s plans for increasing share of Gas in Indian economy’s energy basket from 6% to 15% and having a gas exchange with prices quoted for transacting gas contracts at different delivery points without the complication of determining which pipelines will transport the gas to the delivery point and at what tariff.

- Accordingly on 23rd November 2020, the PNGRB has notified the Petroleum and Natural Gas Regulatory Board (Determination of Natural Gas Pipeline Tariff) Second Amendment Regulations, 2020 bringing forth the Unified Tariff guidelines for implementation (UTP Regulations).

- THE SCHEME

- The UTP Regulations seek to deal with following main aspects:

- Determination of Unified Tariff for the National Gas Grid;

- Streamlining the invoicing and payment mechanism for shipping charges; and

- Inter-se settlement of shipping charges collected between Gas pipeline owners.

- The broad philosophy adopted by the PNGRB in implementing the above is:

- That the user deals with one pipeline entity and not with multiple. One pipeline entity invoices the user as per UTP and thereafter defrays the amounts so collected to all pipeline owners whose pipelines have been used by the user for transportation from entry point till exit point.

- The Approved Tariff for all pipeline owners, as promised to them for reasonable returns on their investment is to be protected and all owners get the Approved Tariff on the volumes transported on their pipeline. Thus the UTP mechanism is not intended to redefine the revenues of Gas pipeline owners.

- There is inter se settlement between the pipeline owners duly mediated by the PNGRB.

- After implementation of the UTP Regulations for the initial period of six months, the PNGRB shall consider suggestions and feedback and suitably modify the regulations to address any working issues or modalities.

- The UTP Regulations seek to deal with following main aspects:

- DETERMINATION OF UNIFIED TARIFF

- The UTP shall be determined by the PNGRB for a financial year at a time. Right has been reserved by PNGRB to also revise UTP mid-year in case of circumstances such as need for rectification or addition of pipeline to National Gas Grid mid-year etc.

- The UTP shall be determined for the entire National Gas grid as a single tariff and shall be further sub-divided into two zones – Zone 1: tariff payable for transportation of gas upto 300 kilometers from point of origin to point of exit and Zone 2: tariff payable for transportation of gas beyond 300 kilometers.

- The UTP for Zone 1 shall be 40% of UTP for Zone 2. For example: If PNGRB determines the UTP for pan India National Grid as Rs. 70 per MMBTU, then this shall be split between Zone 1 and Zone 2 such that Zone 1 UTP is 40% of Zone 2 UTP. Thus in this case the Zone 1 UTP would be Rs. 20 per MMBTU and Zone 2 UTP will be Rs. 50 per MMBTU.

- The UTP for the National Gas Grid will be determined by the PNGRB by applying the following formula (in simplified terms):

UTP = Sum of (Approved Tariffs X Estimated Volumes) for each pipeline forming part of the National Grid + Adjustment Factor

Divided by

Sum of Estimated Volumes for each of the pipelines forming part of the National Grid – Duplicate volumes

- Thus the UTP is not a unique price determined by the PNGRB considering market dynamics but is simply the weighted average of the Approved Tariff expected to be earned by all the pipelines.

- The Adjustment Factor is a variable retained by the PNGRB in the formula to put in an amount it expects to normalize the UTP in case there is under recovery or over recovery of the Approved Tariffs by the pipeline companies owing to under or over estimation of expected volumes versus actual volumes.

- Duplicate volumes are volumes counted twice in reckoning gas expected to be transported from one point of origin to another. For example in case of gas being transported from Dahej by IOC to its Panipat refinery, the volumes would be considered in GAIL pipeline and IOC Dadri Panipat pipeline as well. This would lead to double counting and thus the duplication needs to be excluded when determining the total volume of gas.

- For determination of the UTP, the UTP Regulations provide that each of the owners of the pipelines shall periodically furnish information of the estimated and actual volumes transported by their pipelines with reasons for variance. Formats for submission of information have been prescribed in the UTP Regulations.

- Example illustrating computation of UTP:

| Pipeline | Approved Tariff (Rs/MMBTU) | Estimated Volume (MMBTU) | Expected Revenue (Rs) |

| 1 | 85 | 1000 | 85,000 |

| 2 | 60 | 1500 | 90,000 |

| 3 | 70 | 1500 | 1,05,000 |

| Total | 4,000 | 2,80,000 |

Thus in the above case the UTP shall be 2,80,000/4,000 = Rs. 70 per mmbtu.

For Zone 1 it will be Rs. 20 per MMBTU and for Zone 2 it will be Rs. 50 per MMBTU.

- INVOICING AND SETTLEMENT MECHANISM

- Once the UTP has been determined and declared by the PNGRB for the financial year, the pipeline entities shall invoice the user as per the UTP.

- The ‘Invoicing Entity’ shall be the entity where the customer takes delivery of gas, i.e. the entity owning the pipeline at exit point. It shall invoice the user on the delivered gas volume at the exit point as per the UTP applicable for Zone 1 or Zone 2 as per the distance between origin point of gas of the User and exit point.

- Once the Invoicing Entity has collected the charges, it will be liable to defray the share of the charges to the other pipeline owners whose pipeline has been used by such user between the entry point and exit point.

- Thus, for example, where a user lands a cargo of LNG at Petronet terminal at Dahej and uses the GAIL pipeline from Dahej to Dadri and then IOC pipeline from Dadri to Panipat, in such as case the invoicing entity shall be IOC as the exit point is as at IOC pipeline. IOC will invoice UTP of Zone 2 as the distance transported is more than 300 kms and IOC will then be liable to settle with GAIL the amount collected on behalf of GAIL.

- The inter se settlement will take place between all gas pipeline owners with their preparing a statement of total amount collected by them and the amount they are entitled to as per Approved Tariff for their pipeline and volume transported via their pipelines. Net amount payable/receivable by them to each other will be reconciled and settled.

- In case of any disputes, the same shall be settled by PNGRB.

- IMPLICATIONS

From a business and gas infrastructure perspective, these UTP regulations have a far reaching implication for all entities involved. Some of the implications as analysed are:

- FOR THE USERS:

- For the Users/shippers of gas using the cross-country pipelines, this is a welcome step as it brings transparency in the tariff to be paid by them for transportation.

- It further brings ease of doing business as the user will deal with only a single invoicing entity and will not need to pay multiple invoices for each stretch of the pipeline they use from entry point to exit point to different owners of such stretches.

- As the UTP would be further divided into UTP for Zone 1 and Zone 2, the User can plan its gas movement from source to destination based on the model which most economizes its landed cost of the gas at destination. For example a user requiring gas at Jagdishpur would be able to compare whether to land it at Hazira and transport via Hazira – Vijaipur – Jagdishpur pipeline or to land it at Dhamra and transport via Dhamra – Haldia – Jagdishpur pipeline by considering regasification charges of Shell Hazira terminal and Dhamra terminal as well as UTP applicable from both sources.

- FOR THE GAS PIPELNE OWNERS:

- The UTP guidelines are largely intended to be revenue neutral for the gas pipeline owners. These companies, such as GAIL who have established gas pipelines have an approved tariff which has been approved by PNGRB by considering their Capex, Opex and reasonable return on investment. The UTP guidelines do not disrupt the approved tariff and provide that the UTP based amounts collected by invoicing entities would be distributed between the pipeline owners based on their revenue entitlement as per Approved Tariff.

- From a volume perspective the guidelines would be positive for the pipeline owners who have more pipelines connecting the source to destination within 300 kms as opposed to a pipeline which is longer and falling in Zone 2. For example if IOC is looking to move gas to its refinery in Haldia, it will prefer to use the source point and pipeline which falls within 300 kms (say Dhamra to Haldia) than more than 300 kms (say Dahej to Haldia).

- FOR THE LNG TERMINAL OWNERS:

- The major implication of the UTP guidelines would be for the developers of LNG terminals (on-land and FSRUs). In signing up users for their regasification capacity, the LNG terminal would now have to compete on tariff with other LNG terminals as the user would evaluate the regasification charge + pipeline tariff to determine the most economical option for it to land the gas at the domestic consumption point.

- For example, a user having gas requirement in Bangalore will evaluate whether it is cheaper to land gas from Kochi (Petronet) to Bangalore or Ennore to Bangalore considering the regasification charges at the terminal and the pipeline tariff.

- The regasification charges at terminals will largely get levelized between terminals located in geographical vicinity of each other as an outcome of the UTP and it will not be sustainable for Kochi to charge Rs. 90 per mmbtu while Ennore charges Rs. 60 per mmbtu (for example).

- However, Ennore would not necessarily have to compete with a Dahej since its addressable market i.e. south India would fall in zone 1 for Ennore origin point while it would fall in Zone 2 for Dahej as an origin point. Thus the differential in UTP between zone 1 and zone 2 would negate the lower tariff of Dahej versus Ennore.

- CONCLUSION:

All in all the UTP guidelines are a step in the right direction and should lead to faster adoption of gas across the country. Greater transparency in the pipeline charges and availability of regas capacity with new terminals coming up will yield options to users which will translate to direct imports of LNG by users and higher transactions on gas exchange for delivery at specified points. Gradually gas will become a readily accessible commodity for large users through direct access from international markets as opposed to having to go through state companies. For smaller users the gas exchange will become a transparent and seamless way of buying gas rather than having to negotiate lengthy GSPAs with large gas sellers.

It is a bold and decisive step, taken by Mr. D. K. Sarraf as a parting gift to the Indian Oil & Gas industry, having been one of the most proactive Chairman of the PNGRB ever since the inception of the regulatory body.

*************************************

[1] The author is Director of ValPro – a niche advisory firm specializing in Oil & Gas Sector in India